-

The Federal Reserve will slash interest rates by an eye-popping 275 basis points next year, according to UBS.

-

That’s nearly four times as steep a cut as the market is expecting.

-

UBS expects a mid-2024 recession to encourage the central bank to start easing.

The US economy will slip into recession next year – and that’ll lead to the Federal Reserve bringing in steep interest-rate cuts, according to one top European bank.

UBS said back in November that it’s expecting the Fed to respond to falling inflation and an economic slump by slashing rates by an eye-popping 275 basis points – nearly four times the 75-basis-point reduction the market is currently expecting, per the CME Group’s Fedwatch tool.

“One of the key features of UBS’s forecast is the very pronounced Fed easing cycle seen unfolding from March 2024 onwards,” a team led by economist Arend Kapteyn and strategist Bhanu Baweja said in a research note published mid-November, adding that they expect rates to plunge to just 1.25% in the first half of 2025.

The Fed’s cuts would be “a response to the forecasted US recession in Q2-Q3 2024 and the ongoing slowdown in both headline and core inflation,” UBS added.

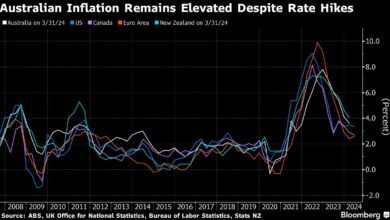

Since March 2022, the Fed has lifted borrowing costs from near-zero to around 5.5% in a bid to clamp down on soaring prices. Inflation hit a four-decade high of 9.1% in June last year, but has since started to cool – although it’s still running way clear of the central bank’s 2% target.

That tightening campaign would be expected to weigh on the economy, but the US has avoided a recession so far. The country’s gross domestic product expanded 4.9% in the third quarter, for its highest growth rate in two years.

Meanwhile, the jobs market has also held up in the face of the Fed’s interest-rate hikes, with the unemployment rate creeping up in recent months but still hovering below 4%.

The recession prediction laid out by Kapteyn and Baweja appears to clash with a separate outlook shared by UBS’s head of asset allocation for the Americas.

Jason Draho said in a presentation that the US economy’s surprising resilience this year has set the stage for a “roaring ’20s” period defined by higher GDP growth, inflation, bond yields, and interest rates.

This story was originally published on November 14, 2023.

Read the original article on Business Insider

Source link